A New Year, 529储蓄计划的新机会

The start of a new year is typically a time when people resolve to implement or recommit themselves to a personal financial goal. 今年, why not consider opening a 529 plan account, or increasing your contributions to an existing account, to enhance your child’s or grandchild’s financial future? 529 plans are the most flexible they’ve ever been since their creation more than 25 years ago.

大学基金...和更多的

Education, in any form, can be a key life building block. A 529 plan is specifically designed for education 储蓄. The main benefit of a 529 plan is tax related: earnings in a 529 account accumulate tax-deferred and are tax-free when withdrawn (which could be many years down the road) if the funds are used to pay qualified education expenses. Some states may also offer a tax deduction for contributions. For withdrawals not used for qualified education expenses, the earnings portion is subject to income tax and a 10% penalty.

In recent years, Congress has expanded the list of expenses that count as “qualified” for 529 plans. Here are some common expenses that qualify:

- 学杂费 — up to the full cost of college/graduate school, /职业中等专业学校, and apprenticeship programs (schools must be accredited by Department of Education and courses can be online); up to $10,K-12的学费是每年1万美元

- 食宿(食宿) -仅适用于大学/研究生院, provided the student is enrolled at least half time

- Computers, required software, internet access, books, supplies -仅适用于大学/研究生院

- 偿还学生贷款 -最高10,000美元的寿命限制

除了, 从2024年开始, families who have extra funds in their 529 account can roll over up to $35,000 to a Roth IRA in the beneficiary’s name, subject to annual Roth IRA contribution limits.

自动的贡献...和更多的

确定, you could build an education fund outside of a 529 plan, but the tax advantages of 529 plans are hard to beat. 此外,529计划还提供其他福利:

- 自动设置的能力, recurring contributions from your checking or 储蓄 account, which automates your effort and allows you to save during all types of market conditions

- 增加的灵活性, 减少, or temporarily stop your recurring contributions, or to make an unscheduled lump-sum contribution, that reflects the ebbs and flows of your financial situation

- The option to choose a mix of 投资s based on the age of the beneficiary, where account allocations become more conservative as the time for college gets closer

- A separate account from your regular checking, 储蓄, 或者经纪账户, which may reduce the temptation to dip into it for a non-education purpose

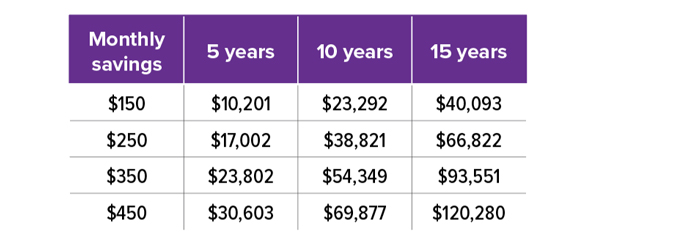

建立教育基金

表格假设年回报率为5%. This is a hypothetical example of mathematical principles and is not intended to reflect the actual performance of any 投资. Rates of return will vary over time, particularly for long-term 投资s. Investments with the potential for higher rates of return also carry a greater degree of risk of loss. Fees 和费用 are not considered and would reduce the performance shown if they were included.

怎样开一个529账户

To open a 529 储蓄 account, select a 529 plan and fill out an application online. You will need to provide personal information, 指定受益人, 选择你的投资选择, and set up automatic contributions or make an initial one-time contribution.

There are generally fees 和费用 associated with participation in a 529 plan. There is also the risk that the 投资s may lose money or not perform well enough to cover college costs as anticipated. The tax implications of a 529 plan should be discussed with your 法律 and/or tax professionals because they can vary significantly from state to state. Most states offering their own 529 plans may provide advantages and benefits exclusively for their residents and taxpayers, 其中可能包括经济援助, 奖学金基金, 以及对债权人的保护. 在投资529计划之前, 考虑投资目标, 风险, 指控, 和费用, which are available in the issuer’s official statement and should be read carefully. The official disclosure statements and applicable prospectuses, which contain this and other information about the 投资 options, 潜在的投资, 投资公司, can be obtained by contacting your financial professional.